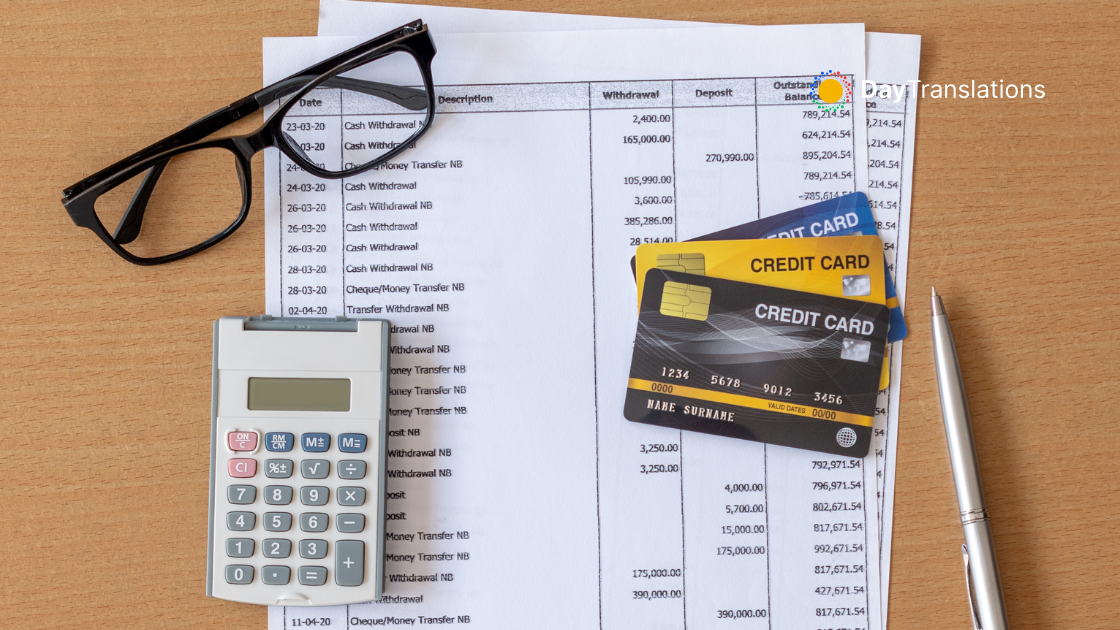

Big and small businesses now focus on the global market, generating financial statements and records from different countries. This could mean doing business in other currencies or languages and transactions subject to various jurisdictions’ rules.

This is where financial translation comes in. As a CPA or translator, part of your job description at a company will be gathering these records and statements and converting the currencies used in the transactions into one reporting currency.

This guide looks in-depth at translating financial statements, highlighting important insights you should know as a CPA or translator, or if you intend to venture into this industry.

Understanding Financial Reporting

Financial reporting is the method by which businesses give interested parties their financial state. It entails compiling thorough documents like the income statement, cash flow statement, and balance sheet, all of which are crucial in assessing a company’s health and performance.

In this process, certified public accountants are absolutely vital. They create these reports using accepted accounting standards like GAAP or IFRS. No less vital is the role of the translators.

For readers in different languages, understanding these difficult documents depends much on context. Their task is to convert technical vocabulary into other languages without losing the intended meaning.

Working together, CPAs and translators ensure that financial statements are clear in their intended marketplaces, accurate, and approachable to all interested parties globally.

What CPAs and Translators Need to Know

Accounting Principles

A solid grasp of accounting principles stands as the cornerstone for both CPAs and translators. CPAs must apply generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) when preparing financial statements.

Translators, while not dealing with much of the technical accounting stuff, need to familiarize themselves with these frameworks to convey complex concepts accurately in another language.

For instance, they need to understand terms like “assets,” “liabilities,” and “equity” to ensure that translations maintain the original intent. When accountants and translators share a common language around these principles, they foster better collaboration.

Clarifying International Standards

CPAs and translators need to have a firm grasp on international standards like IFRS and GAAP in addition to accounting principles. These concepts ensure consistency internationally by guiding how the financial statements are prepared.

CPAs rely on these rules to confirm that their opinions are in accordance with the laws of the countries in which they operate. Translators need to be aware of (and understand) how these rules have impacted reporting styles and language. For instance, some countries may focus more on revenue recognition than others, and some countries may prefer expense matching.

Understanding these variations helps translators produce accurate translations that align with local practices without altering the core meaning.

The Importance of Collaboration

Another dimension to consider is collaboration. Good financial translations are not a one-man job. Each player brings their own unique skill-set to the equation. As interpreters know the subtleties of language, so CPAs know the subtleties of accounting methods.

Translation FAQs and any uncertainties are addressed with regular communication. For example, a CPA can offer clarification about certain rules that apply or industry lingo that does not easily cross over.

When the two specialists work together, each focusing on what they know best, the caliber of translations rises. This calls for mutual respect; the CPA respecting the translator’s expertise and vice versa. Building a positive workplace culture can be instrumental here.

Leveraging Technology

Every aspect of running a business is becoming increasingly dependent on technology; it’s taking up most mundane roles, which means it will replace some low-skilled employees, but there is nothing to worry about if you know your trade.

It also means proficiency at a particular instrument can greatly improve accuracy and speed. It could also mean that you are more valuable as an employee, increasing your job security.

Software like CAT (computer-assisted translation) tools helps translators maintain consistency across projects, while accounting software enables CPAs to produce accurate financial statements efficiently. However, you have to remember that technology cannot take the place of skill; you will need both to succeed. Machines only make your work easier.

Dealing with Typical Problems in Financial Translation

Like every other job, translating financial statements brings difficulties that are specific to the industry. First, there is the challenge with terminology localization and context loss.

It is important to look out for poor management. If present, these problems could create misunderstandings or inaccuracies. For instance, a word with a precise meaning in one financial system could not have a direct counterpart in another language, which could mean the intended communication is missed or distorted.

Adopting best practices is vital to bridge this gap between finance and language. Close communication among CPAs and translators helps clarify intent and context during translation.

Pursuing a Career as a CPA

You could be interested in a career in CPA, but you do not have sufficient information about this career path. Here are a few things you may need to know. As the bare minimum, you must have formal education and training.

Most roles demand at least a bachelor’s degree in accounting or finance. There are also state-specific requirements, so you may need to take a course to satisfy state licensing requirements. Many would-be CPAs also undertake internships to obtain pragmatic experience.

Demand is projected to increase as companies depend more and more on financial knowledge, so job possibilities for CPAs are still excellent. Recent statistics show that the average CPA annual pay is $122,229, which makes it a career worth considering.

Pursuing a Career as a Financial Translator

If you are interested in a career in financial translation, you will need to work on your language skills and learn about financial ideas. Having a degree in translation, linguistics, or finance often helps. Good translators also seek certifications to show they are experts and trustworthy in this area.

The need for talented translators keeps growing as companies spread around the world. As the world becomes more connected, job chances stay good for those who can help with language differences in money matters.

How much you earn depends on your experience and what you specialize in. But skilled financial translators can make good money for each project or hour they work. Aim for proficiency in more than one language, as that ensures more marketability and ultimately better earnings.

Final Thoughts

As most businesses go global, translating financial statements will be a massive part of what you do as a CPA and a financial translator.

This move to an international approach to doing business also means that demand for professionals proficient in financial translation will increase over the years. It also means that a career in finance is something you may want to consider exploring.

Sorry, the comment form is closed at this time.